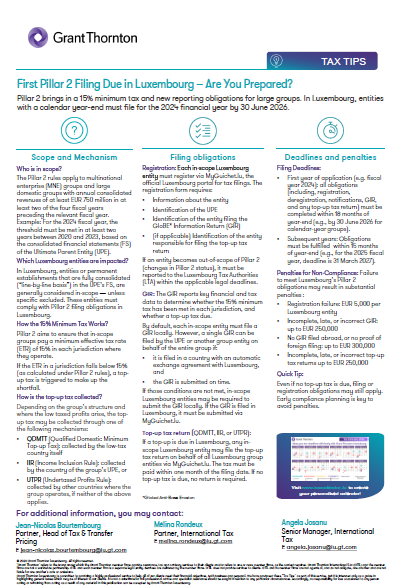

Scope and Mechanism

Who is in scope?

The Pillar 2 rules apply to multinational enterprise (MNE) groups and large domestic groups with annual consolidated revenues of at least EUR 750 million in at least two of the four fiscal years preceding the relevant fiscal year. Example: For the 2024 fiscal year, the threshold must be met in at least two years between 2020 and 2023, based on the consolidated financial statements (FS) of the Ultimate Parent Entity (UPE).

Which Luxembourg entities are impacted?

In Luxembourg, entities or permanent establishments that are fully consolidated (“line-by-line basis”) in the UPE’s FS, are generally considered in-scope — unless specific excluded. These entities must comply with Pillar 2 filing obligations in Luxembourg.

How the 15% Minimum Tax Works?

Pillar 2 aims to ensure that in-scope groups pay a minimum effective tax rate (ETR) of 15% in each jurisdiction where they operate.

If the ETR in a jurisdiction falls below 15% (as calculated under Pillar 2 rules), a top-up tax is triggered to make up the shortfall.

How is the top-up tax collected?

Depending on the group’s structure and where the low taxed profits arise, the top-up tax may be collected through one of the following mechanisms:

- QDMTT (Qualified Domestic Minimum Top-up Tax): collected by the low-tax country itself

- IIR (Income Inclusion Rule): collected by the country of the group’s UPE, or

- UTPR (Undertaxed Profits Rule): collected by other countries where the group operates, if neither of the above applies.

Filing obligations

Registration

Each in-scope Luxembourg entity must register via MyGuichet.lu, the official Luxembourg portal for tax filings.

The registration form requires:

- Information about the entity

- Identification of the UPE

- Identification of the entity filing the GloBE* Information Return (GIR)

- (if applicable) Identification of the entity responsible for filing the top-up tax return

If an entity becomes out-of-scope of Pillar 2 (changes in Pillar 2 status), it must be reported to the Luxembourg Tax Authorities (LTA) within the applicable legal deadlines.

GIR

The GIR reports key financial and tax data to determine whether the 15% minimum tax has been met in each jurisdiction, and whether a top-up tax due.

By default, each in-scope entity must file a GIR locally. However, a single GIR can be filed by the UPE or another group entity on behalf of the entire group if:

- It is filed in a country with an automatic exchange agreement with Luxembourg, and

- The GIR is submitted on time.

If those conditions are not met, in-scope Luxembourg entities may be required to submit the GIR locally. If the GIR is filed in Luxembourg, it must be submitted via MyGuichet.lu.

Top-up tax return (QDMTT, IIR, or UTPR)

If a top-up is due in Luxembourg, any in-scope Luxembourg entity may file the top-up tax return on behalf of all Luxembourg group entities via MyGuichet.lu. The tax must be paid within one month of the filing date. If no top-up tax is due, no return is required.

*Global Anti-Base Erosion

Deadlines and penalties

Filing Deadlines

- First year of application (e.g. fiscal year 2024): all obligations (including, registration, deregistration, notifications, GIR, and any top-up tax return) must be completed within 18 months of year-end (e.g., by 30 June 2026 for calendar-year groups).

- Subsequent years: obligations must be fulfilled within 15 months of year-end (e.g., for the 2025 fiscal year, deadline is 31 March 2027).

Penalties for Non-Compliance

Failure to meet Luxembourg’s Pillar 2 obligations may result in substantial penalties :

- Registration failure: EUR 5,000 per Luxembourg entity

- Incomplete, late, or incorrect GIR: up to EUR 250,000

- No GIR filed abroad, or no proof of foreign filing: up to EUR 300,000

- Incomplete, late, or incorrect top-up tax returns up to EUR 250,000

Quick Tip

Even if no top-up tax is due, filing or registration obligations may still apply. Early compliance planning is key to avoid penalties.